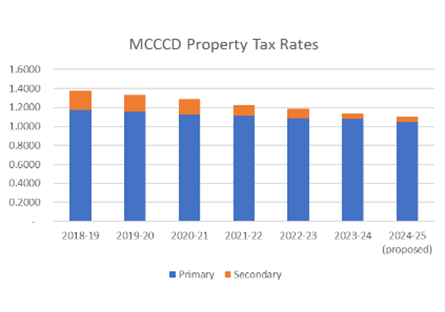

Bar graph chart showing MCCCD's property tax rates from FY 2018/19 to proposed tax rates for FY2024/25.

Today, the Maricopa County Community College District (MCCCD) Governing Board will hold a “Truth and Taxation” hearing. During the regular meeting, the Governing Board is set to take action on proposed increases to MCCCD’s primary property taxes on existing property in FY 2024-25, while also actualizing savings from the secondary rate. As a result of the Governing Board’s intended action, the total combined primary and secondary tax rates will decrease by 3%, resulting in an overall lower tax burden for the average Maricopa County taxpayer.

“The vote tonight will continue to demonstrate the commitment the Governing Board and the District office has in utilizing resources that positively impact Maricopa County residents and taxpayers,” Governing Board President Susan Bitter Smith said. “This vote will not only lower the tax burden for County taxpayers but continue paving the way for students and offer more cutting edge workforce development programs and baccalaureate degrees,” President Bitter Smith continued. “On behalf of the Governing Board, I would like to thank the hard work and dedication of our faculty, staff, and the District Office for making this possible.”

Understanding the full property tax involves two parts: the primary and secondary rates. It is important to note that property owners pay more than just primary taxes. Maricopa County taxpayers are also assessed secondary taxes to cover the principal and interest costs associated with the MCCCD’s 2004 General Obligation bonds, as these costs have declined in recent years.

For example, while the primary property taxes levied by MCCCD on a $100,000 home will rise from $103.86 to $104.86 ($1.00 or 0.96% year over year), the total combined primary and secondary tax rates ($1.1047) and property tax levied by the District will decline from $113.88 to $110.47. This results in a savings of $3.41 or 3%. This strategy has been employed by the MCCCD Governing Board for the last six years, resulting in an overall decline in the combined property tax rates of 19.7% as shown in the left corresponding image.

Arizona Revised Statutes require MCCCD to hold a “Truth in Taxation” hearing when the Governing Board considers adopting a budget that includes an increase in the total amount of primary property tax dollars levied or collected in the upcoming fiscal year. The dollars generated through the property tax levy will be used to support the capital costs of maintaining MCCCD’s buildings and facilities, allowing MCCCD to continue serving its diverse student population and community at large.

MCCCD has a proven track record of reducing the burden on taxpayers and providing affordable, accessible postsecondary education. This includes non-credit training, certificates, associate degrees, and now bachelor’s degrees to students across ten college campuses and 31 satellite locations strategically positioned throughout the Valley. Visit Maricopa.edu to learn more.